ATLANTA--(BUSINESS WIRE)--BitPay, the largest global blockchain payments provider, today announced another record year along with key accomplishments and expansion of the payment processing platform for 2018 after more than seven years in business.

Cryptocurrency payment services firm BitPay has partnered with tax-related financial products company Refundo to enable people to get a portion of their tax refund back in bitcoin (BTC). BitPay's Adopted Conventions for Bitcoin Cash Addresses, URIs, and Payment Requests; What does the BitPay wallet's warning 'amount too low to spend' mean? How do I sweep a paper wallet into BitPay/Copay? Why am I getting an 'amount below minimum allowed' error? Can I reverse a transaction from my BitPay wallet? Do I still own old bitcoin addresses?

In 2018, BitPay processed over a $1 Billion again in payments and set a new record for transaction fee revenue by adding new customers like Dish Networks, HackerOne, and the State of Ohio. BitPay’s B2B business also had a record year as it grew almost 255% from the previous year as many law firms, data center providers, and IT vendors signed up to accept Bitcoin. BitPay also hired Rolf Haag, Former Western Union and PayPal executive as Head of Industry Solutions responsible for the B2B business.

Open the BitPay App. Click the gear icon in the tabs bar (bottom). Scroll down until the Crypto Wallets & Keys section. Click the wallet key you want to delete. Click Delete (last option on the bottom). Click Delete and OK. To delete a specific wallet within a wallet key.

“BitPay’s B2B business continues to grow rapidly as our solution is cheaper and quicker than a bank wire from most regions of the world,” said Stephen Pair, Co-founder and CEO of BitPay. “To process over a $1 Billion for a second year in a row despite Bitcoin’s large price drop shows that Bitcoin is being used to solve real pain points around the world.”

Last year, BitPay also set a record for reducing payment error rates. The dollar volume lost to cryptocurrency payment errors dropped dramatically from over 8% (in December 2017) to well under 1% of BitPay's total dollar volume processed.

“The adoption of support for Payment Protocol wallets has made a big difference for our merchants,” said Sean Rolland, Head of Product of BitPay. “Merchants are now able to easily accept Bitcoin payments in a simple easy way without any support issues. This was our biggest request by our enterprise merchants.”

BitPay also added settlement support for Bitcoin Cash and stable coins from Circle, Gemini, and Paxos. However, BitPay still remains laser focused on Bitcoin.

“Bitcoin has the network effect around the world and we are still extremely bullish on Bitcoin and the Bitcoin ecosystem,” added Rolland.

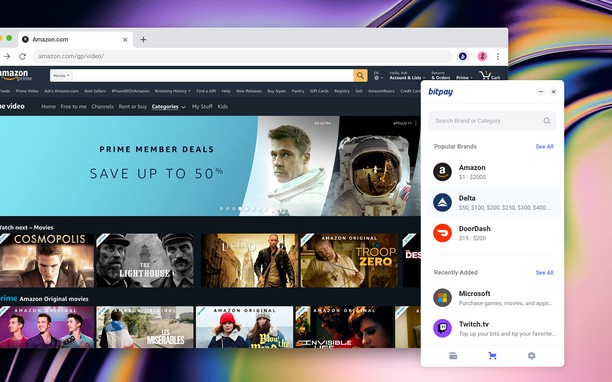

The Copay wallet, BitPay wallet, and other wallets using BitPay's Bitcore Wallet Service (BWS) have sent billions of dollars in value in Bitcoin and Bitcoin Cash in 2018. Users have created over 1.5 million wallets to date using BitPay and Copay. In the past year, the BitPay wallet added integrations with major gift card brands, enabling users to buy gift cards in-app for travel, food, and shopping with Bitcoin and Bitcoin Cash.

As a company, BitPay grew headcount by 78% in 2018 as they now have close to 80 employees. New employees were hired across the board in sales, engineering, support, and compliance.

Bitpay Irs Account

BitPay also raised $40 Million in Series B funding bringing its total raised capital to over $70 Million. New investors in BitPay include Menlo Ventures, Capital Nine, G Squared, Nimble Ventures (an affiliate of Passport Capital) and Delta-v Capital as well as individual investments from Christopher Klauss Family Office, Founder of Internet Security Systems (ISS), and Alvin Liu, Co-founder of Tencent. Aquiline Capital Partners led the initial Series B Round but extended the round due to increased investor demand.

About BitPay

Bitpay Irs

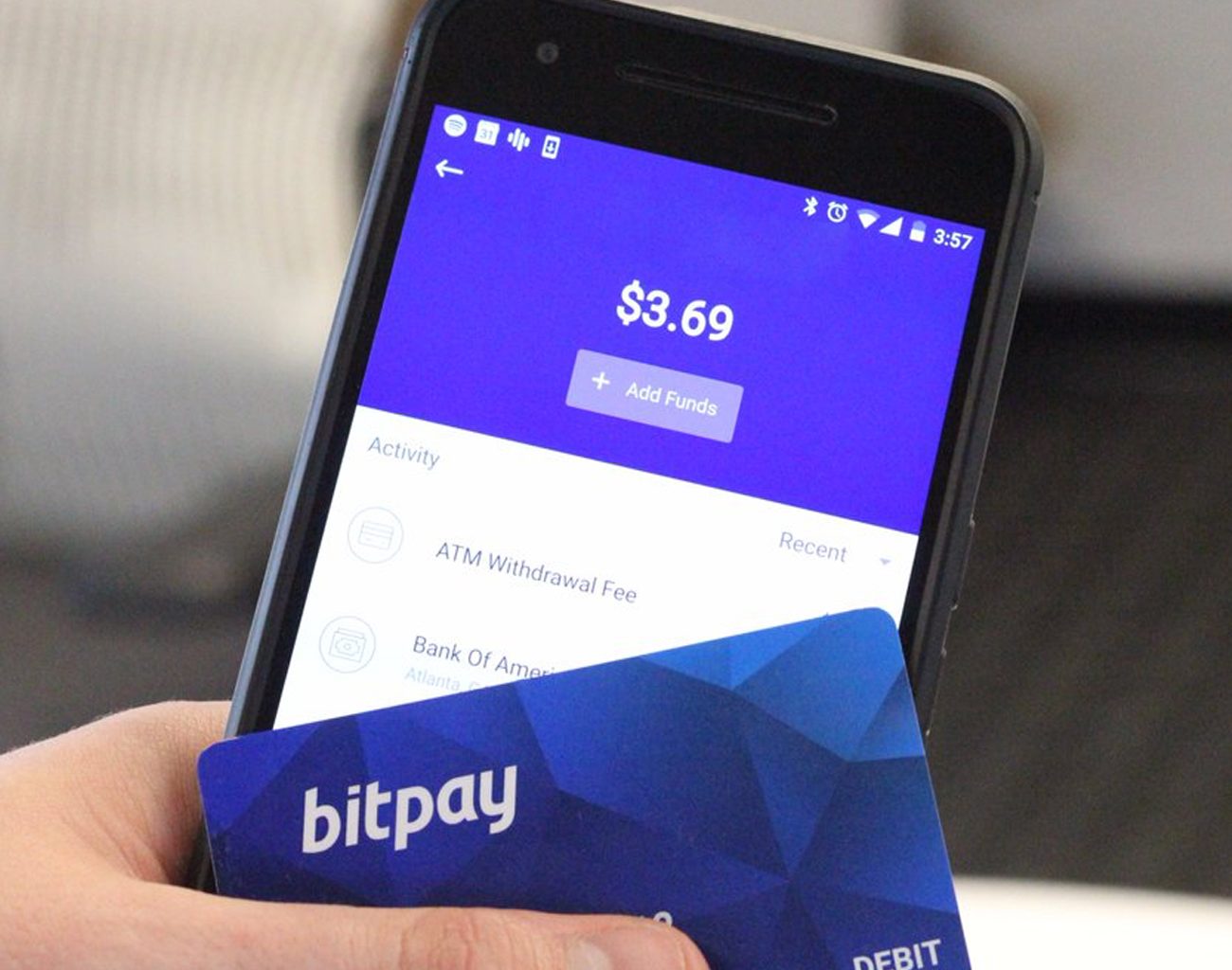

Founded in 2011, BitPay is the pioneer and the most experienced company in Bitcoin and blockchain payments. Its suite of products enables businesses to send and receive cross border payments, also enabling consumers to manage digital assets with the BitPay Wallet and turn digital assets into dollars with the BitPay Prepaid Visa® Card. The company has offices in North America, Europe, and South America and has raised over $70 million from leading investors including Founders Fund, Index Ventures and Aquiline Technology Growth. For more information visit https://bitpay.com

The BitPay Visa® Prepaid Card is issued by Metropolitan Commercial Bank, member FDIC, pursuant to a license from Visa, U.S.A. Inc. “Metropolitan” and “Metropolitan Commercial Bank” are registered trademarks of Metropolitan Commercial Bank © 2014. Use of the Card is subject to the terms and conditions of the applicable Cardholder Agreement and fee schedule, if any.

Comments are closed.